Advances in chip design and power efficiency are reshaping investor views on who benefits most from the next phase of technology innovation.

Investor sentiment in technology markets is increasingly influenced by a quieter but consequential shift: innovation is moving from brute-force computing scale toward efficiency, optimization, and cost control. This transition is altering how equities across semiconductors, hardware, and enterprise software are valued.

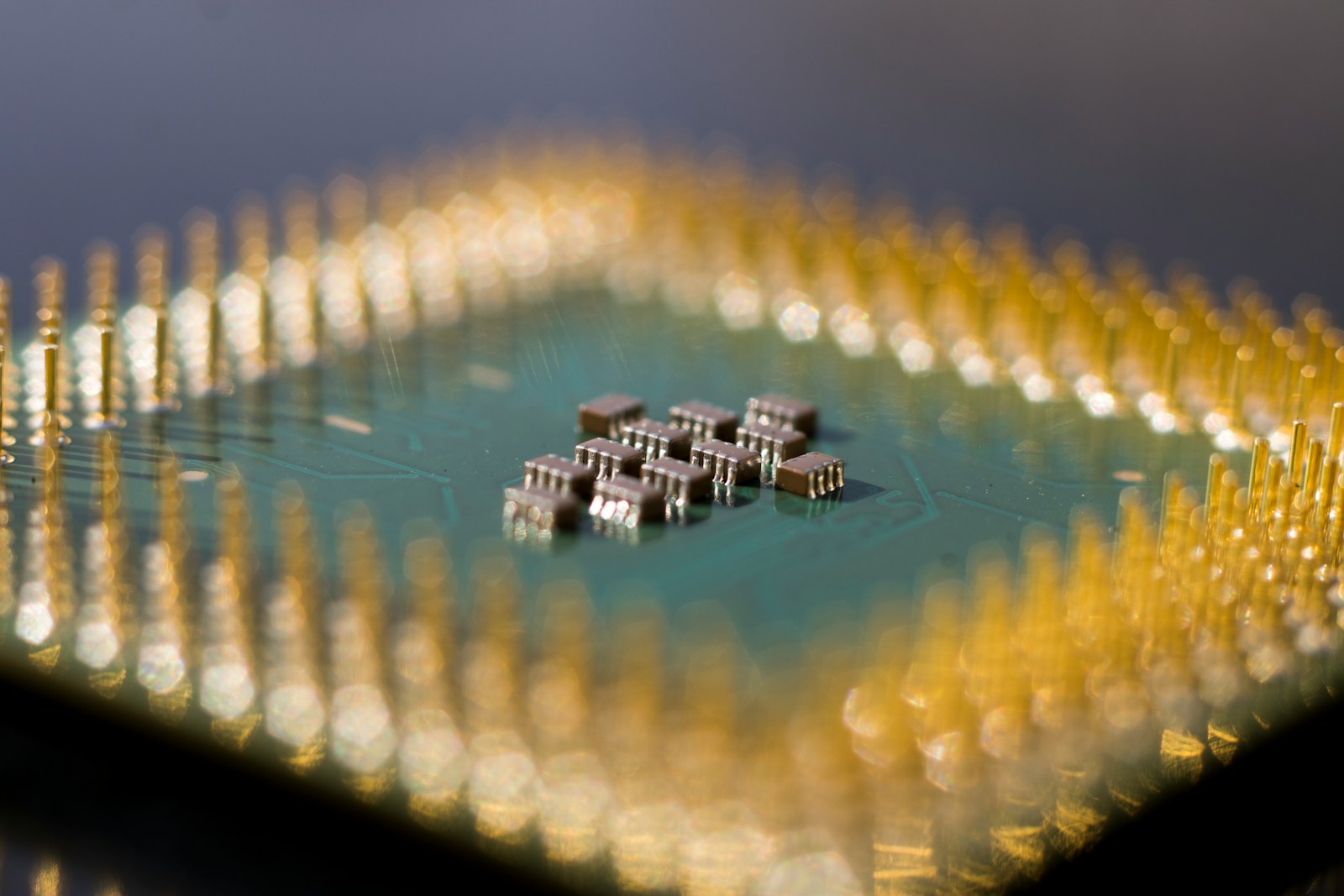

Chipmakers are again at the center of the narrative, but the emphasis is evolving. Nvidia (NVDA) remains dominant in high-performance AI workloads, yet investors are paying closer attention to how customers reduce power consumption and total cost of ownership. That focus has lifted interest in companies developing more specialized or energy-efficient architectures, including Advanced Micro Devices (AMD), whose latest processors are being adopted in environments where performance per watt matters as much as raw speed.

Efficiency is also benefiting firms that design custom silicon. Broadcom (AVGO) has emerged as a key beneficiary as large cloud providers seek application-specific chips to lower long-term operating costs. The stock’s performance reflects confidence that custom design work can generate durable, high-margin revenue streams even as overall capital spending growth moderates.

This theme extends to cloud platforms themselves. Alphabet (GOOGL) and Microsoft (MSFT) have highlighted internal efforts to improve data-center utilization through software optimization and proprietary hardware, reassuring investors concerned about rising depreciation and energy expenses. Markets have responded favorably to signs that capital intensity may plateau even as AI-related demand continues to expand.

Enterprise software companies are also adapting. Rather than promoting AI as an add-on feature, vendors are increasingly positioning it as a way to reduce customer costs through automation and workflow simplification. ServiceNow (NOW), for example, has benefited from investor belief that efficiency-driven use cases are easier to monetize during periods of cautious corporate spending.

Consumer technology remains more constrained. Apple (AAPL) continues to emphasize efficiency gains in its chips to offset slower unit growth, but equity markets are waiting for clearer evidence that these advances translate into renewed demand rather than incremental improvements for existing users.

Taken together, technology innovation is entering a phase where returns depend less on who spends the most and more on who spends smartest. For investors, that shift is sharpening the divide between companies that can convert efficiency into earnings leverage and those still reliant on ever-rising capital outlays.