A decisive win for Prime Minister Sanae Takaichi’s ruling party lifted stocks worldwide, even as Japan’s debt load put investors on alert.

A sweeping election victory in Japan delivered what markets typically prize most: clarity. Investors pushed Tokyo equities to fresh records Monday after Prime Minister Sanae Takaichi’s Liberal Democratic Party secured a commanding mandate in the lower house, reducing near-term political uncertainty around fiscal and economic policy.

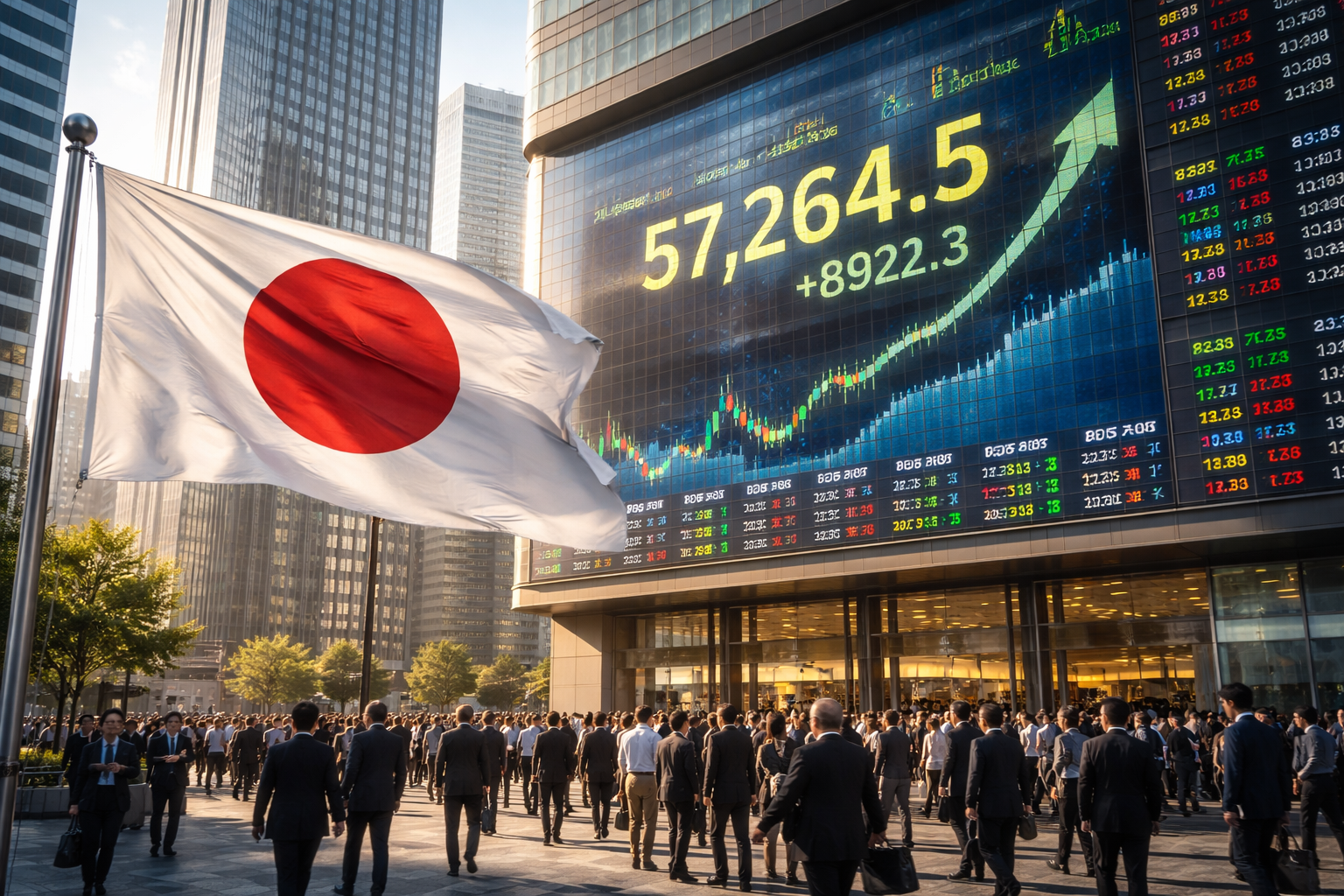

Japan’s Nikkei 225 surged to an intraday high above 57,000 before closing sharply higher, helping pull regional and European markets along with it. The broad move had the feel of a classic “risk-on” session—equities higher, safe-haven positioning reduced, and a renewed bid for cyclicals tied to growth expectations.

For global investors, Japan is less about one day’s index level and more about what comes next: the interaction between fiscal ambitions, the yen, and bond-market tolerance. Takaichi has signaled a preference for stimulus, including a large package and targeted tax relief. The immediate equity rally suggests traders see a path toward demand support and corporate-friendly policy, but Japan’s government debt and funding strategy remain the constraint that can quickly re-price enthusiasm—particularly if deficit spending pressures yields higher.

Currency moves were mixed as traders weighed stronger growth expectations against the potential for heavier issuance and shifting rate differentials. That balance matters beyond Japan: a firmer yen can tighten financial conditions for Japanese exporters, while a weaker yen can export disinflation and influence global portfolio flows into U.S. and European assets.

The broader backdrop is a global economy that, at least on paper, is grinding forward rather than stalling. The IMF’s January update pointed to steady world growth in 2026, leaving markets unusually sensitive to political surprises that can tilt fiscal settings or trade expectations.

For equity investors, Japan’s renewed momentum is also a reminder that governance reform and shareholder returns remain central to the bull case. Export-heavy bellwethers like Toyota Motor (TM) and global index proxies such as iShares MSCI Japan ETF (EWJ) stand to benefit if a stronger mandate translates into sustained corporate and market-structure changes—so long as the bond market doesn’t force an abrupt turn toward austerity.