Investors are rewarding semiconductor firms positioned at the core of enterprise AI deployment, not just experimentation.

The rally in artificial intelligence stocks is entering a more selective phase, with investors increasingly differentiating between hype-driven narratives and companies supplying the hard infrastructure needed to scale AI workloads. Nowhere is that clearer than in AI-focused chipmakers, where demand signals remain strong even as broader technology valuations face scrutiny.

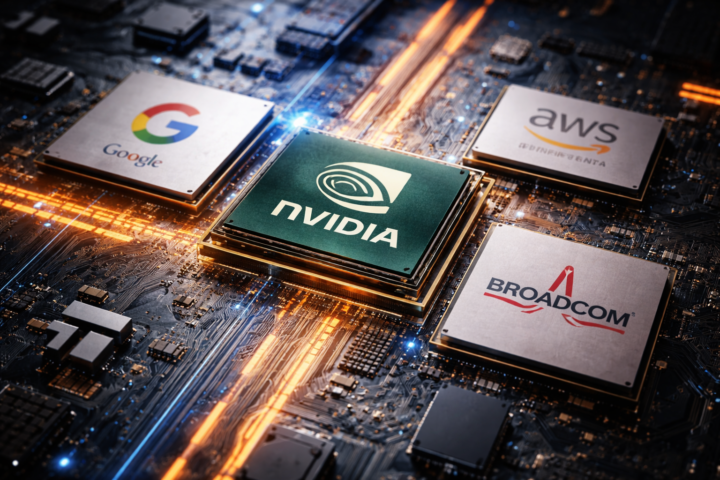

Nvidia (NVDA) continues to anchor the sector. The company’s data center revenue growth has reinforced its position as the default supplier of high-performance graphics processing units used to train and run large language models. Cloud providers and enterprise customers alike are prioritizing Nvidia’s ecosystem, from its CUDA software to its networking hardware, making it difficult for rivals to displace its dominance in the near term.

That concentration of demand, however, is also shaping investor behavior. While Nvidia remains the bellwether, attention is spreading to second-tier beneficiaries. Advanced Micro Devices (AMD) has gained traction as hyperscalers look to diversify suppliers, particularly for inference workloads where cost efficiency matters more than absolute performance. AMD’s recent momentum reflects expectations that AI deployment will broaden beyond a handful of mega-customers.

Traditional chipmakers are also being re-rated through an AI lens. Taiwan Semiconductor Manufacturing Co. (TSM), the world’s largest contract chipmaker, has emerged as a critical enabler of the AI boom, producing advanced nodes for Nvidia, AMD, and other designers. Its capital spending plans are increasingly viewed as a proxy for long-term AI demand rather than cyclical smartphone or PC trends.

At the same time, investors are becoming more cautious about peripheral AI plays. Semiconductor equipment makers and memory suppliers have benefited from early optimism, but stock performance has diverged as markets assess whether current spending levels are sustainable. Companies with clear visibility into multi-year AI infrastructure buildouts are outperforming those reliant on shorter-term capacity cycles.

The next phase for AI chip stocks is likely to hinge on execution rather than narrative. Margins, supply constraints, and customer concentration risks are moving back into focus as earnings season approaches. For now, the market’s message is clear: AI remains a powerful structural trend, but capital is flowing most aggressively to companies that can translate that demand into durable cash flows.